Brand Valuation in Practice

A Partnership Between DANISTER and SMD Group

Together, we introduce you to the topic of brand valuation and provide an innovative brand value calculator directly on this page.

We are pleased to announce the partnership between DANISTER and the SMD Group. Together, we introduce you to the topic of brand valuation and provide an innovative brand value calculator directly on this page for a fast, indicative, and independent brand valuation. With DANISTER SPEED and DANISTER SPEED+, you can obtain an initial estimation of your brand’s monetary value within minutes.

Brand Research

The SMD Group offers research on brands, company names, domains, designs, and titles to verify third-party rights.

Brand Valuation

DANISTER provides professional brand valuations to determine the financial and strategic value of brands.

Brand Monitoring

The SMD Group offers comprehensive brand monitoring to detect trademark infringements worldwide at an early stage.

Brand Valuation

Reliable methods for determining the financial and strategic value of your brand

Why Are Brands So Important?

Brands are far more than just a logo or a name. They represent customer trust and loyalty, as well as the value a company holds in the market. A strong brand can be the decisive factor between business success and failure. Therefore, knowing the value of your brand is crucial. A comprehensive brand valuation not only provides transparency about its current value but also serves as a solid basis for strategic decisions, investments, and negotiations.

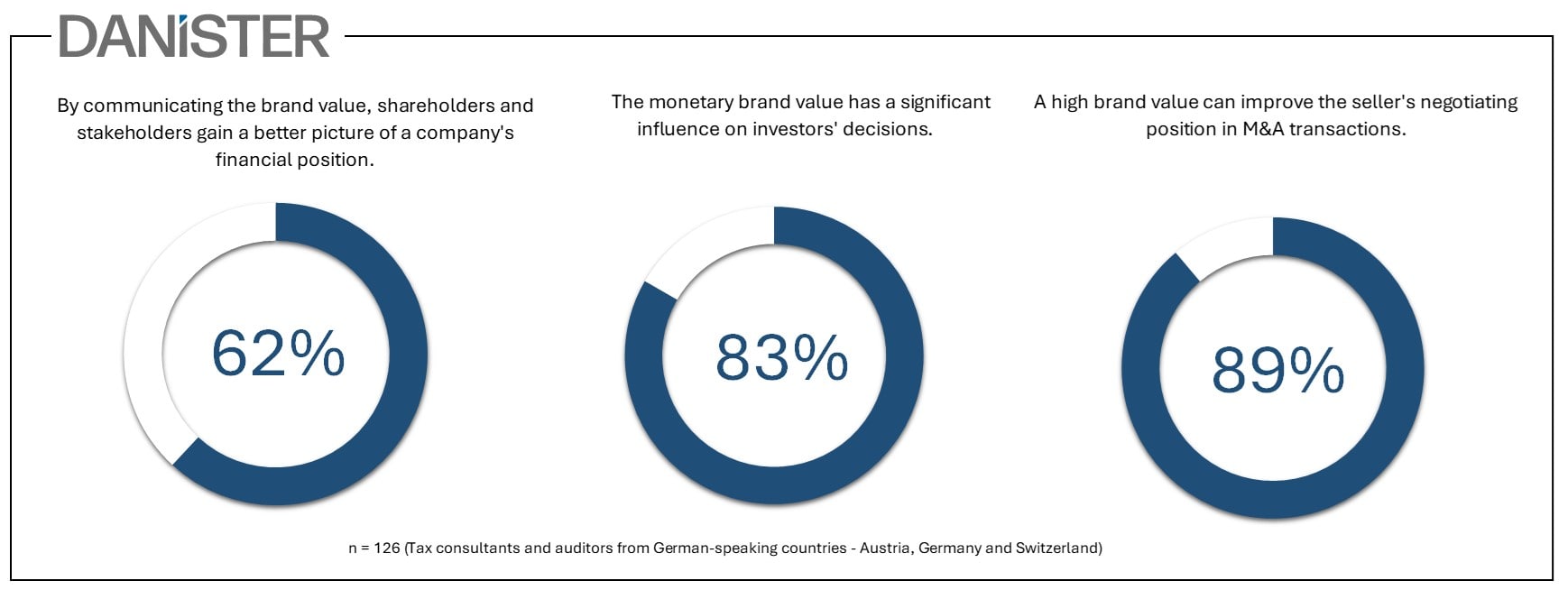

Key Insights from Recent Studies:

Making Brand Value Visible

Who wouldn’t want to know the value of their own brand? As entrepreneurs, we have a strong interest in understanding the financial impact of our brand efforts. While accounting regulations may impose limitations, the perceived value of our brand in the eyes of customers and the market is of immense importance. It is time to unlock this potential and establish a tangible value for hidden reserves such as brands.

Activating brand in the balance sheet

Accounting regulations prevent us from recognizing self-created brands as assets in our balance sheets (§ 248 Abs. 2, S. 2 HGB; IAS 38.48 & 38.63; § 197 Abs. 2 UGB), leaving us without a tangible value for our brand. However, this does not mean that its value does not exist.

Purchase Price Allocation (PPA)

Purchase Price Allocation (PPA) is a process carried out after a business acquisition to allocate the purchase price to the acquired company’s various assets and liabilities. A key component of this process is brand valuation.

For self-created brands, their value is often not recorded in the seller’s balance sheet, as accounting regulations prohibit the recognition of internally developed intangible assets such as brands. It is only during a transaction that the true value of a brand becomes visible through PPA and is recognized in the buyer’s balance sheet. The brand value is separately assessed and allocated to the buyer’s intangible assets. This process allows for a clear observation of the brand’s share in the overall purchase price.

Notable Brand Transactions

A brand’s value only becomes visible through a transaction (M&A)—specifically in the buyer’s balance sheet.

Volkswagen Group (Audi AG) – Ducati Motor S.p.A. (2012)

Transaction Price: 747 million EUR

Brand as a Component of the Purchase Price

Brand Value: 404 million EUR

Brand Share: 54%

Gerry Weber International AG – Hallhuber (2015)

Transaction Price: 86,2 million EUR

Brand as a Component of the Purchase Price

Brand Value: 41,4 million EUR

Brand Share: 48%

Bayer (Consumer Health) – Dihon Pharmaceutical Group Co. Ltd. (2014)

Transaction Price: 401 million EUR

Brand as a Component of the Purchase Price

Brand Value: 295 million EUR

Brand Share: 74%

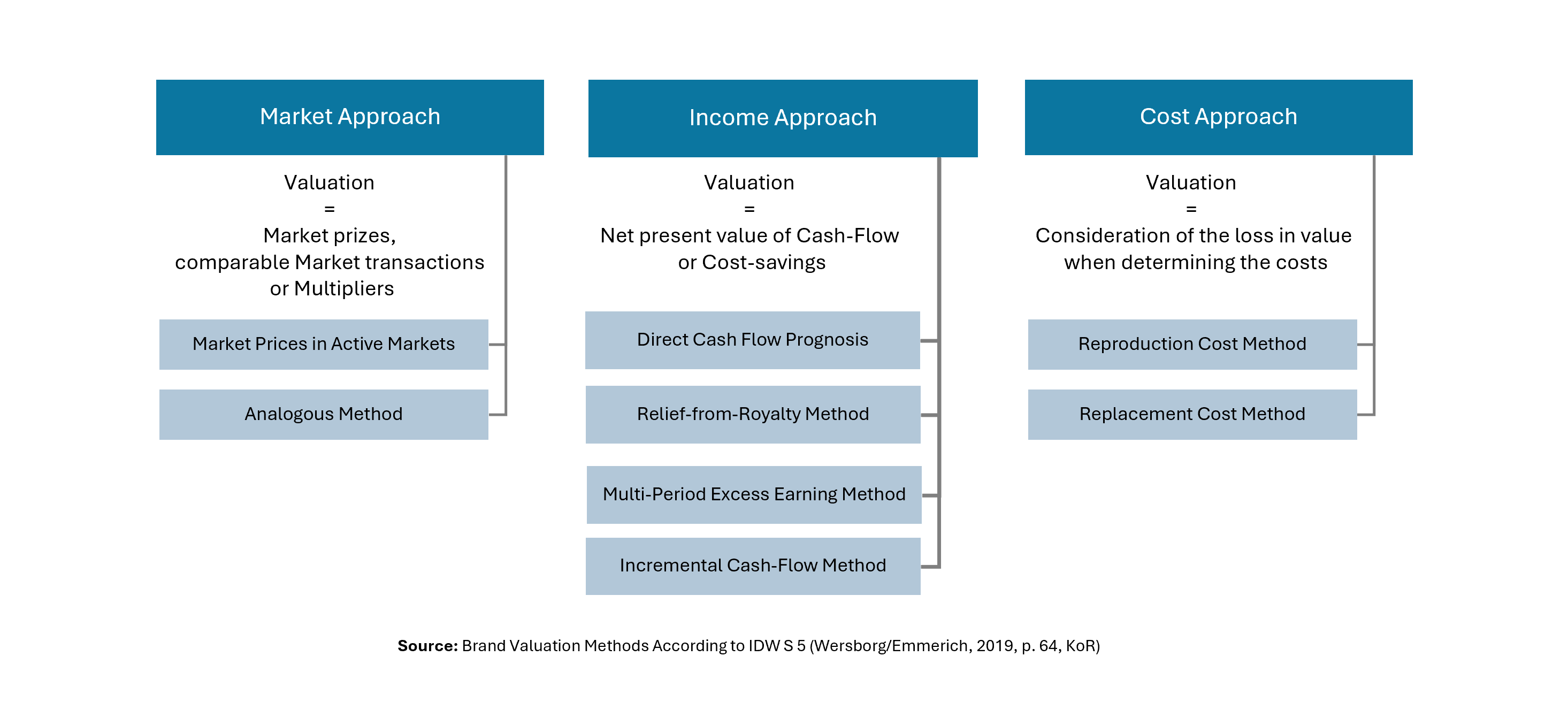

Brand Valuation – Methods

There are three primary valuation approaches for intangible assets: market-based, capitalized value, and cost-based methods. Each approach consists of various valuation techniques. However, both theory and practice agree that the monetary value of an intangible asset—including brands—should generally be determined based on the expected future financial benefits a buyer can derive from the asset. This aligns with corporate valuation principles, such as the Discounted Cash Flow (DCF) method. As a result, capitalized value-oriented methods are preferred, considering the purpose, context, and available information of the valuation. (IDW S 5 (2015), Sec. 18, p. 5; DIN ISO 10668 (2010), pp. 3-7)

Cost-based methods

In cost-based methods, the value of a brand is derived from the effort required to reproduce the brand. In this process, the costs that would be necessary for an exact duplicate of the brand can be considered (Reproduction Cost Method). Alternatively, the brand value can be derived from the costs required for the creation or acquisition of an asset with equivalent utility (Replacement Cost Method).

Market-based methods

In a market-based method, the value is derived from observable market prices. In this process, the analogy method can also be applied, where a comparison is made between the observable price of a comparable brand and the brand value to be determined.

Capitalized value methods

According to the capitalized value method, the value of an intangible asset or a brand is determined by the sum of the present values of future cash flows expected to be generated from the use of the intangible asset over its economic useful life as of the valuation date. Within the capitalized value method, all relevant sub-methods can generally be applied, with various valuation techniques available. (IDW S 5 (2015), Sec. 28f., p. 7; DIN ISO 10668 (2010), pp. 4f.)

Both in academic literature and practical application, there is broad consensus that the license price analogy within capitalized value-oriented methods is one of the most suitable and frequently used approaches for brand valuation. (Binder (2010), p. 921; Castedello/Kreher (2010), p. 80; Lüdenbach/Hoffmann/Freiberg (2016), p. 2147 (Rn. 226); Paugam et al. (2016), pp. 98 & 129)

Practical Application

Crucial for sustainable brand protection, strategic investments and maximizing company value.

From Practice: Why Brand Valuation?

Literature highlights the shift from tangible to intangible assets and their growing importance for the future. Intangible assets are becoming increasingly strategically relevant, significantly contributing to growth and productivity, while the role of tangible assets in increasing company value is gradually declining.

Brands as key value drivers

According to a study by Ocean Tomo, intangible assets now account for 90% of total corporate value when measured by the market price of the S&P 500.

Brands, in particular, play an increasingly significant role in a company’s overall value. As the German Patent and Trademark Office aptly states: “Brands are capital and key influencing factors that can enhance a company’s total value.”

Various studies confirm the growing impact of brands on corporate valuation.

A 2019 PwC study found:

- 51% of respondents consider the value contribution of brands to be one of the most important factors influencing overall corporate value.

- 42% believe that the impact of brands will increase significantly compared to other assets.

Another study highlights the substantial role of brands from the perspective of auditors, tax advisors, and M&A consultants:

- In the B2C sector, brands contribute an indicative 31–40% of total company value.

- In the B2B sector, this range is 21–30% (M&A Review, 2019).

Reasons for Brand Valuation

Financial Orientation

- Purchase, Sale, Mergers

- External Communication

- Investor Relations

- Accounting

- Licensing

- Legal Infringements

- Credit Security

- Investment Decisions

Marketing- / Behavior-Oriented Valuation

- Strategic Management and Control

- Internal Communication

- Performance Monitoring

- Budget Allocation

- Resource Deployment

- Product Development

- Efficiency and Effectiveness Control

- Brand Portfolio Optimization

Brand valuation: A success factor in mergers and acquisitions

Brand Valuation as the Key to Success

Optimal strategic positioning in mergers and acquisitions

The complexity of a business acquisition, generational succession, merger, or divestment is often driven by financial and tax considerations. Valuation gives the brand substance, influences negotiations, and plays a crucial role in contract finalization. This is because self-created brands are not recorded in financial statements. A separate brand valuation in the M&A process provides potential buyers with clear insights into the company’s value drivers, strengthening their confidence—often leading to a higher purchase price. It highlights the brand’s contribution to market positioning, customer loyalty, and profitability, reinforcing the seller’s price expectations. Especially for established brands with strong future potential, brand value can represent a significant portion of the total company value. A well-founded brand valuation ensures fair pricing, minimizes risks, substantiates the sales value, and maximizes the chances of successful transactions and long-term synergies.

Outsourcing of brand rights to IP companies

Brand Valuation as a Critical Factor

Brand valuation is essential for accurately determining value when outsourcing to an IP company and for mitigating risks.

When establishing an IP company to which brand rights will be transferred, a brand valuation is indispensable. It enables a precise assessment of the value being transferred and supports the strategic management and monetization of brand rights, as demonstrated by Siemens AG. In this case, brand rights were contributed as assets to a specially founded Trademark GmbH & Co. KG. Additionally, this approach separates brand rights from the risks associated with the operating business, ensuring greater financial and legal security.

Sale-and-lease-back of brands

Brand Valuation in Sale-and-Lease-Back Transactions

Brand valuation is crucial in sale-and-lease-back transactions to determine the sales value and ensure market-based conditions.

Companies use sale-and-lease-back transactions to free up capital by selling brand rights and subsequently leasing them back. Brand valuation plays a key role in determining the sales value and ensuring that the transaction takes place under fair market conditions.

(Example: The Valensina brand.)

Brand valuation as a strategic value driver

Accurate Brand Valuations Support

A precise brand valuation helps companies optimize their strategy, strengthen their market presence and create added value.

The insights gained from an accurate brand valuation go beyond mere numbers. Companies can recalibrate their strategic direction, position themselves more clearly within their market segment, and base strategic actions on solid insights. Which brand valuation levers can be identified as value drivers, and how do they contribute to increased brand value and overall business success?

Financial and strategic clarity

Financial Insight

Financial insight provides strategic direction.

Brand valuation offers not only financial but also strategic clarity. By allocating financial resources effectively, companies can strengthen their brand and expand their brand reach. How deeply is my brand embedded in the minds of customers? How is this reflected in the brand’s value?

Brand valuation as a lever for capital acquisition and growth enhancement

Brand as a Means of Capital Acquisition

The key to securing capital and expansion opportinities.

Brand valuation also paves the way for capital acquisition. The monetary value of a brand can serve as collateral for financing agreements, unlocking new opportunities for growth and expansion. (Even Calvin Klein used the brand as a financing instrument; Bezant, M. 1998, p. 253.)

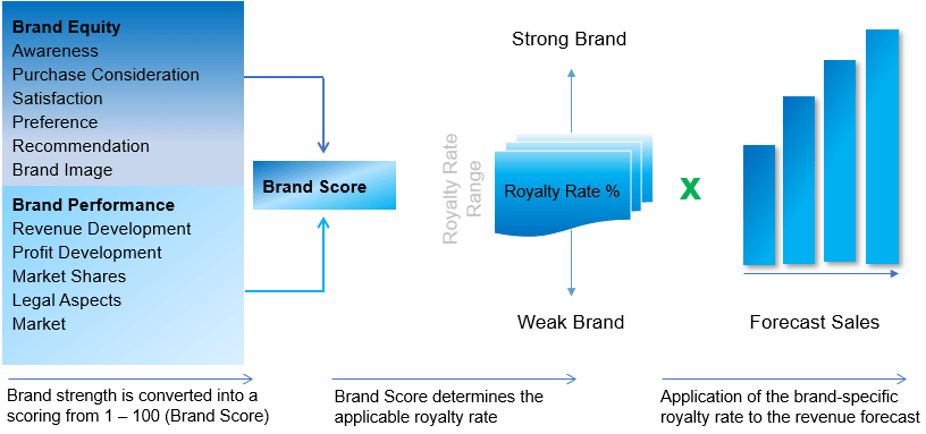

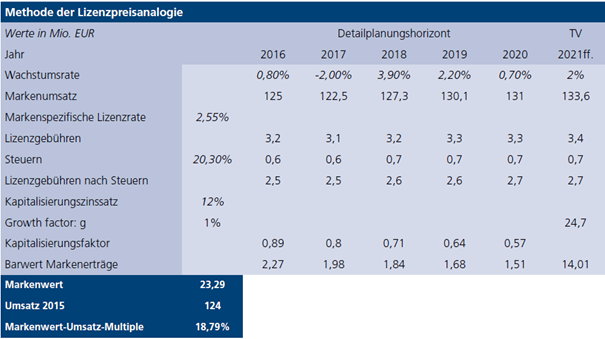

The license price analogy method

The License Price Analogy

A proven valuation method

The license price analogy is an internationally recognized method for brand valuation (in accordance with IDW S5, DIN ISO 10668, and ÖNORM A 6800). It is widely used by renowned companies. For example, Adidas applied this method during the purchase price allocation of runtastic GmbH in 2015, and Gerry Weber International used it for the acquisition and valuation of the Hallhuber brand in the same year.

The license price analogy is a well-established brand valuation method based on the “Relief-from-Royalty” approach. This method determines a brand’s value by estimating the hypothetical license fees that the owner would have to pay if they were licensing the brand from a third party. The core assumption is that brand ownership provides an economic advantage by eliminating the need for royalty payments. To calculate the brand’s value, comparable market license rates from similar brands in the same industry are analyzed. These royalty rates are applied to the brand’s future projected revenue and discounted to present value using an appropriate discount rate. This approach provides an indicative brand value assessment, reflecting the potential financial benefits that the brand offers to the company.

Digital Solutions

Innovative solutions for precise analyses and well-informed decisions on brand values.

The Brand Value Calculators by DANISTER

With the DANISTER SPEED and SPEED+ brand value calculators, you have access to intuitive tools that simplify and accelerate the brand valuation process. The input parameters are clearly defined and easy to understand.

Step 1: Set up revenue planning

Enter the last revenue generated with the brand. Based on this, you can now specify the planned annual revenue growth rate (in percentage) for the detailed planning phase. Typically, a detailed planning phase spans between 3 to 5 years. Key question: How much will brand revenues grow in the coming years (forecast)?

Step 2: Determine the tax rate

The calculation of brand value using capital value-oriented methods must be performed on an after-tax basis according to IDW and DIN ISO 10668. The applicable tax system is that of the country where these financial surpluses are taxed. You can either refer to databases (e.g., OECD) to obtain the tax rate or use your company’s own corporate tax rate as an indication.

Step 3: Approximate the hypothetical license rate

The license price analogy aims to isolate the brand.

Key question: What would a company have to pay for a brand if it did not own it? In other words, what would be an appropriate or hypothetical royalty rate for the brand that one would be willing to pay? Simplified, this can be compared to a calculated “brand rent.” To determine this, companies can refer to comparable real licensing agreements from databases or derive an appropriate royalty rate based on brand strength. (Our experts are happy to assist you with this.) At this stage, a company can consider what revenue-based royalty rate it would be willing to pay for the right to use the brand—if it were not the owner. Typical royalty rates range between 1-5%, depending on the industry.

Step 4: Define the brand-specific capitalization rate

In the capital value-oriented approach, future cash flows are discounted using a risk-adjusted discount rate. In practice, the Weighted Average Cost of Capital (WACC) of the company serves as the basis. As an approximation, the company’s WACC can be used. Typically, for brand valuation, a risk premium of 1-3% is added to the WACC. If the WACC is not readily available, various databases can be used to derive an indicative WACC.

Step 5: Select the brand’s useful life

Key Question: How long will the brand generate these hypothetical licensing revenues? Will it be 5 years, 10 years, 15 years, or is the time frame uncertain because the brand is so strong that an end is not foreseeable (Terminal Value; TV)?

Use DANISTER’s digital brand value calculators to independently determine the monetary value of your brand. Conduct an indicative brand value check based on the internationally recognized valuation methodology according to IDW S5 and DIN/ISO 10668.

What is the Benefit?

Speed

Get an immediate indicative assessment of your brand’s value.

Reliability

The valuation is based on the proven license price analogy.

Flexibility

Results for analyses, strategic decisions, or negotiations.

Scenarios

Calculate different scenarios based on your assumptions to determine the brand value as realistically as possible.

Simplicity

The user-friendly calculator guides you step by step through the process, while the complex calculations run in the background.

Based on this data, the brand value calculators provide an indicative brand value within minutes.

Our Cooperation

Research, valuation and monitoring of brands are essential for a successful brand journey.

A Successful Partnership

Together, we offer comprehensive solutions to accurately determine the value of your brand, identify potential risks at an early stage, and ensure continuous market monitoring.

Markus Weishaupt

Weishaupt Consulting GmbH

DANISTER is a simple tool for the complex question: “How much is my brand worth?”

With just a few parameters, DANISTER provides a pragmatic approach to brand valuation and, above all, a focused, professional insight into the topic. Highly recommended.

Tankred Vogt

DANISTER GmbH

The prerequisite for a brand’s value is its existence as an independent economic asset.

Research and continuous monitoring ensure the establishment and sustainability of a brand. The result is reflected in the brand’s value: Successful brands are the outcome of a clear strategy – both in terms of protection and awareness of their own worth.

Stefan Märk

University of Applied Sciences Salzburg

Current circumstances compel entrepreneurs to unite all potential.

An asset that is once again coming into focus is the brand itself and its significant potential value. The value of every brand lies dormant within a business, but only through strategic optimization can it realize its full worth.

Service-Portfolio DANISTER

The following services and products are available to you at DANISTER.

Digital Tools

- DANISTER SPEED

- DANISTER SPEED+

- DANISTER EMOTION

Expert Reports & Assessments

- Brand Value Reports

- Digital Assessments

- Immediately Available

Brand Valuation

- IDW S5 & DIN/ISO

- Objective Assessment

- Potential Values

Service-Portfolio SMD Group

The following services and products are available to you at SMD Group.

Research

- Brands and Logos

- Companies

- Domains

- Designs

- Titles

Monitoring

- Brands and Logos

- Companies

- Domains

- Designs

- Titles

Online Tools

TMZOOM

- Research (Brands/Logos | Designs | Titles)

- Monitoring